P2PE

PCI DSS P2PE

What is P2PE?

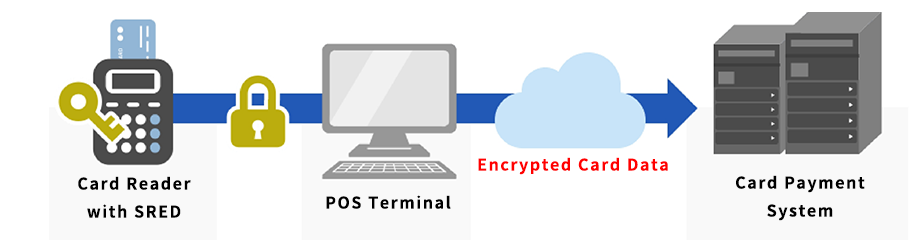

PCI SSC (Payment Card Industry Security Standards Council) has established the P2PE (Point-to-Point Encryption) standard to ensure the secure handling of credit card data through encryption.

This outlines in detail how to reduce the scope of PCI DSS audits and how to validate P2PE solutions. With this system, card data remains encrypted from the moment it is read by POS/POI devices until it reaches a secure decryption environment, significantly reducing the likelihood of data exposure.

*For merchants with several branches, specific stores can be excluded from PCI DSS assessment requirements.

Advantages of Implementing P2PE

Implementing P2PE ensures that card data is never decrypted within the merchant's system, significantly reducing the risk of data breaches caused by POS malware and other threats. Using a PCI SSC-validated P2PE solution also allows merchants to limit the scope of PCI DSS compliance assessments and substantially reduce the number of Self-Assessment Questionnaire (SAQ) items.

Merchants operating several branches may reduce their PCI DSS assessment scope by excluding specific locations.

Because of these advantages, P2PE is highly regarded as an effective method for enhancing card data security.

ICMS P2PE Compliance Service

Our company has been actively engaged in the P2PE field since its early stages and operates as an accredited P2PE assessment organization.

To become a P2PE *QSA (Qualified Security Assessor), holding a PCI DSS QSA qualification is a mandatory prerequisite.

Leveraging our extensive experience and advanced skills gained from PCI DSS audits in Japan, we deliver professional assessments with a deep understanding of P2PE requirements.

*QSA: A PCI DSS assessor certified by the PCI Security Standards Council.

ICMS Solutions offers comprehensive consulting services for P2PE compliance.

Our dedicated team of experts provides end-to-end support—from gap analysis and roadmap development to implementation and assessment preparation.